I still remember the first time I watched a potential customer lose interest while waiting for a quote. We’d promised to “get back by tomorrow.” By evening, they were already insured—with someone else. That moment taught me a hard truth: insurance quoting isn’t just paperwork, it’s the first real impression.

Traditional insurance quoting has always been a bit of a patience test. Endless forms, manual calculations, back-and-forth emails… by the time a quote arrives, the customer’s excitement is gone. For insurance brokers, this slow insurance quoting process quietly bleeds opportunities every single day. No one likes waiting—especially when they’re comparing three tabs and a WhatsApp message at the same time.

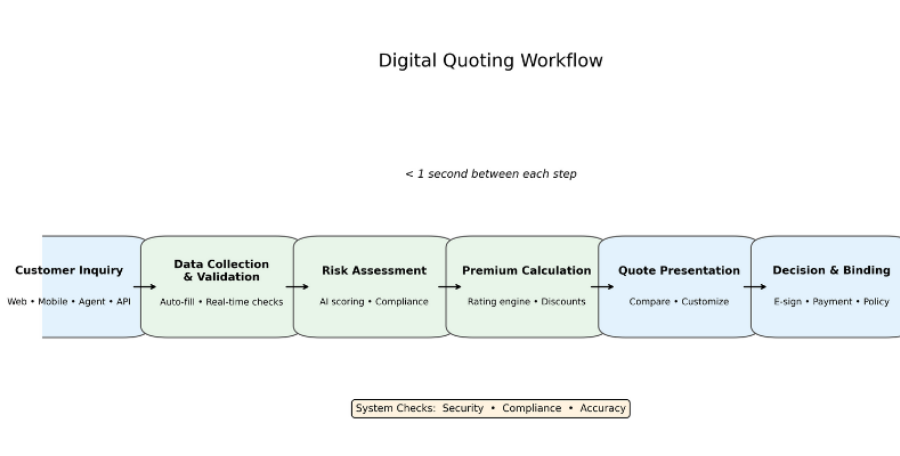

This is where modern insurance quoting starts to feel like a breath of fresh air. Thanks to Insuretech, what once took days now takes minutes. Smart insurance broker software pulls data instantly, adjusts premiums accurately, and delivers insurance quoting that actually fits the customer—not a generic template. Faster insurance quoting doesn’t just save time; it builds trust.

The best part? Insurance quoting today is no longer just about speed. It’s about clarity, personalization, and confidence. When insurance brokers can generate precise insurance quoting on the spot, conversations change. Customers ask better questions. Decisions happen faster. And yes, conversions quietly improve.

The industry is shifting, whether we like it or not. Insurance quoting powered by modern insuretech tools is becoming the new normal. Those who embrace smarter insurance quoting workflows stay relevant. Those who don’t… well, they keep promising to “get back tomorrow.”

The Traditional Quoting Process: Challenges and Limitations

- I’ve seen insurance quoting turn into a waiting game—files piled up, phones buzzing, and customers slowly losing patience. Traditional insurance quoting starts with manual data entry, where details are typed and retyped across systems, draining time and energy from insurance brokers.

- Then come the calculations. Old-school insurance quoting depends on underwriters crunching numbers by hand, flipping tables, and double-checking formulas. One quote can eat up hours, sometimes days.

- With manual insurance quoting, mistakes slip in. A small typo can throw off premiums, creating confusion, rework, and awkward follow-up calls no one enjoys.

- Slow insurance quoting hurts conversions most. When quotes don’t arrive fast, customers quietly move on.

- Limited flexibility is another pain. Traditional insurance quoting rarely allows easy comparisons, making customers feel boxed in.

- This is why insurance broker software and insuretech are stepping in—to make insurance quoting faster, clearer, and far less stressful.

What Modern Insurance Quoting Should Look Like

Real-time quote generation :

Insurance quoting today should feel instant. When someone asks for a price, modern insurance quoting delivers it in seconds, not days—because no one enjoys waiting longer than a coffee break.

Automated data validation Smart :

Insurance quoting uses automation to fill in details and double-check data. This saves customers from repeating themselves and saves insurance brokers from fixing avoidable errors.

Accurate risk assessment :

With intelligent systems, insurance quoting becomes more accurate. Advanced rules quietly assess risk in the background, so pricing stays fair and consistent.

Multi-product comparison capabilities :

Good insurance quoting lets people compare options easily. Coverage, deductibles, and premiums update in real time, making choices feel simple, not overwhelming.

Mobile-friendly access :

Mobile-friendly insurance quoting matters. Quotes should look just as good on a phone as on a desktop.

Personalized pricing models :

Behind the scenes, insurance broker software powered by insuretech personalizes insurance quoting, turning generic prices into tailored offers customers actually trust.

Key Features of Advanced Quoting Software :

Instant Premium Calculations

At the heart of advanced tools is fast insurance quoting. Automated engines handle the math quietly in the background, so insurance quoting that once took hours now appears in seconds—no calculator, no crossed fingers.

Seamless System Connections

Good insurance quoting doesn’t live in isolation. Modern insurance broker software connects CRMs, policy systems, and data sources smoothly, keeping insurance brokers from jumping between screens all day.

Flexible Underwriting Rules

Markets change, and insurance quoting must keep up. Custom rule engines let teams tweak pricing and eligibility without calling IT, making insurance quoting feel refreshingly flexible.

Quote Anywhere, Anytime

With multi-channel access, insurance quoting works on desktops, mobiles, and agent portals alike—thanks to smart insuretech design.

Cleaner Data, Fewer Mistakes

Pre-filled forms make insurance quoting faster and more accurate, turning long forms into quick conversations.

Insights That Actually Help

Analytics turn everyday insurance quoting into lessons that improve pricing, performance, and confidence.

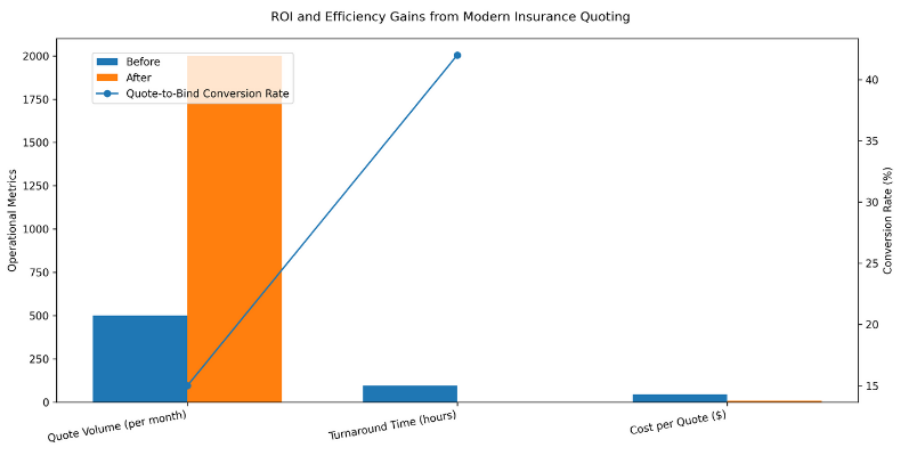

Why Carriers Feel the Difference

When insurance quoting is instant, carriers see fewer drop-offs and more completed policies. Automated insurance quoting cuts manual work, lowers costs, and improves accuracy. With smart insuretech, pricing updates quickly, helping carriers stay competitive without the usual scramble.

Benefits for Different Stakeholders :

How Brokers Get Their Time Back

For insurance brokers, fast insurance quoting means fewer forms and better conversations. Modern insurance broker software lets them create multiple quotes in minutes, compare carriers easily, and respond confidently—sometimes before the client finishes their coffee.

What Customers Actually Enjoy

Customers love clear, simple insurance quoting. Instant results, transparent pricing, and easy comparisons make decisions less stressful. Self-service insurance quoting also means they can explore options anytime, without waiting for office hours.

The Big Picture

When insurance quoting works smoothly for everyone, trust builds faster—and business follows naturally.

If you’re ready to simplify insurance quoting and give your team the speed customers now expect, it’s worth taking a closer look at Fondostech. Their insurance broker software, built with practical insuretech at its core, helps insurance brokers quote faster, sell smarter, and grow without chaos.

Visit fondostech.in to book a quick demo, explore how modern insurance quoting really works, or speak with an expert who understands your daily challenges.