Buying insurance can feel like standing in a crowded market where everyone claims to have the “best deal.” Somewhere in that noise, you’ll hear two terms again and again: insurance broker and insurance agent. They sound alike, but they don’t play the same role—and that difference can change everything for you.

Think of it this way: one works like a personal shopper, the other like a brand representative. Who they work for shapes the advice you get, the options shown to you, and whose side they’re really on when things get tricky. Knowing this isn’t just useful—it can save you money, stress, and future regret.

Today, insurance is also getting a tech makeover. Smart software, faster claims, and digital tools are cutting delays and clearing confusion. What once felt slow and paperwork-heavy is becoming simpler and more open.

In this guide, we’ll break it all down in plain language. No jargon. No sales talk. Just clear help so you can choose the right expert—and feel confident protecting what matters most.

What is an Insurance Agent?

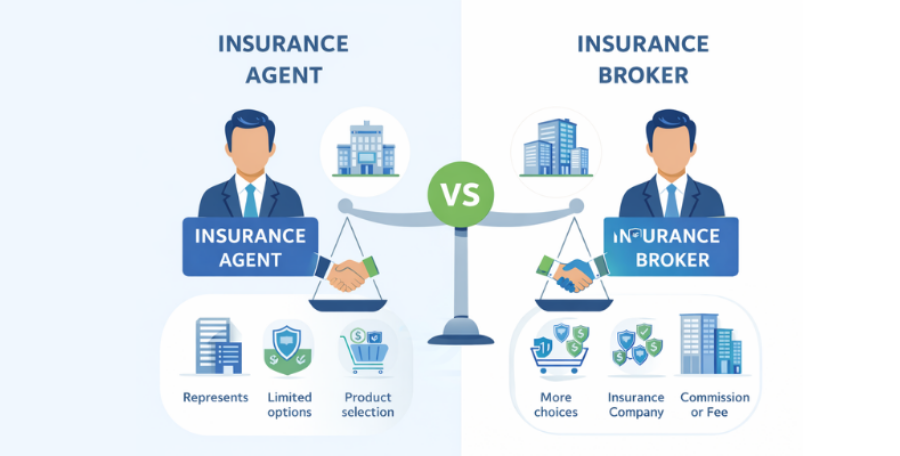

An insurance agent is a trained and licensed person who sells insurance policies for insurance companies. Their main job is to help people and businesses buy insurance. But remember—an agent represents the insurance company, not the customer. You can think of them like a shopkeeper selling one or more brands of insurance.

Types of Insurance Agents

1. Captive Agent

A captive agent works for only one insurance company. They can sell only that company’s policies. Because of this, they know their products very well, but they can’t offer alternatives from other companies.

2. Independent Agent

An independent agent works with many insurance companies. This allows them to compare plans and suggest options from different insurers based on your needs.

What Does an Insurance Agent Do?

- Understand your insurance needs

- Suggest suitable policies

- Explain coverage in simple language

- Help with buying, renewing, or changing policies

- Guide you during claims (company handles final claim process)

How Do Agents Get Paid?

Agents earn commission from the insurance company. Some get a fixed salary plus commission, others earn only commission. They also earn renewal commission every year.

Pros and Cons

Pros:

- Personal help

- Easy communication

- Product knowledge

- Multiple options (with independent agents)

Cons:

- Limited choices (captive agents)

- Advice may favor higher commission plans

License Rules

Agents must pass exams, get licensed, and follow insurance laws. They also need regular training to keep their license active.

Insurance Broker: Definition and Role

What is an Insurance Broker?

An insurance broker is a licensed expert who works for you, not any insurance company. Their role is to search the market and find the best policy for your needs and budget. Think of them as your personal insurance advisor.

How Insurance Brokers Are Different from Agents

- Agents represent insurance companies.

- Brokers represent clients.

- Brokers must legally act in your best interest.

What a Broker Does

- Study your risks and needs.

- Compare policies from many insurers.

- Explain pros, cons, and hidden limits.

- Negotiate price and terms.

- Help strongly during claims and disputes.

How Brokers Get Paid

They earn commission or charge a clear service fee. Good brokers always tell you how they’re paid.

Pros of Brokers

- More choices

- Honest advice

- Strong claim support

Cons of Brokers

- May charge fees

- Too many options for simple needs

Licensing

Insurance Brokers must be licensed, trained, and regularly updated on insurance laws and ethics.

Head-to-Head Comparison: Broker vs Agent

Side-by-Side Comparison

| Factor | Insurance Agent | Insurance Broker |

|---|---|---|

| Represents | Insurance company / carrier | Client / policyholder |

| Product Selection | One company (captive) or limited carriers (independent) | Extensive market access across numerous carriers |

| Fiduciary Duty | Owes duty to insurance company | Legal fiduciary duty to client |

| Commission Structure | Earns commission from insurer; may have salary component | Commission from carriers or fee-based client charges |

| Expertise Level | Deep product knowledge of specific carriers | Broad market knowledge and risk management expertise |

| Best Suited For | Simple personal insurance needs, brand loyalty preferences | Complex commercial risks, specialized coverage, advocacy needs |

Making Your Choice: Agent or Broker?

Picking between an insurance agent and a broker isn’t about who’s “better.” It’s about who fits your situation.

1. How complex are your needs?

If you just need car, bike, or home insurance, an agent can handle it easily. But if you run a business, own expensive assets, or need special coverage, a broker is usually the safer bet. They can search more options and spot gaps you might miss.

2. Think beyond the price

Premiums often look similar. The real difference shows later. A broker may save you money by structuring better coverage or preventing claim rejections. Agents offer faster, simpler choices.

3. How much support do you want?

If you want someone firmly on your side during claims, choose a broker. They are legally bound to protect your interests. Agents help too, but they work for the insurer.

4. Your industry matters

Some businesses face unique risks. Brokers usually understand niche industries better and access special insurers.

Smart Questions to Ask

- Who do you work for—me or insurers?

- How do you earn money?

- Have you handled clients like me before?

- What help will I get during claims?

Watch Out for Red Flags

Avoid anyone who rushes you, hides fees, avoids comparisons, or promises “guaranteed” claims.

Always Verify

Check licenses, reviews, certifications, and references before deciding. A little homework now can save big trouble later.

Conclusion

Knowing the difference between an insurance agent and an insurance broker puts you in control. Agents sell policies for insurance companies. They’re quick, focused, and work well for simple needs. Brokers, on the other hand, work for you. They search the market, explain the fine print, and stand by your side when claims get tough.

There’s no one-size-fits-all answer. If your needs are basic, a good agent may be enough. If things are more complex—business risks, high-value assets, or special coverage—a broker’s wider view and strong support can make a big difference.

Today, technology has raised the bar for both. Smart insurance software, digital tools, and faster claims systems mean less paperwork and fewer headaches, no matter who you choose.

In the end, the title doesn’t matter as much as the person. Pick someone licensed, honest, and easy to talk to. Ask questions. Compare options. Trust your gut. Insurance is about peace of mind, and the right professional helps you sleep better at night, knowing what matters most is protected. Visit fondostech.in and book appointment.