An insurance broker license is basically your green light to work in the insurance world the right way. It’s what allows you to legally help people sort through policies, compare options from different insurance companies, and choose coverage that actually makes sense for their lives. Unlike agents who work for just one insurer, insurance brokers work for the client—and that independence is a big deal.

In this blog, we’ll break down what an insurance broker license is, why it matters, and exactly how to get one. No fluff—just clear steps and practical insight to help you get started

1. Why a Broker License Matters

Getting a broker license is often the moment people realize insurance can be more than paperwork. When I earned my first broker license, I stopped being tied to one insurer and started working for real people. That’s the heart of the insurance broker role—independence backed by a broker license.

With a broker license, an insurance broker can compare policies across the insurance business instead of pushing a single option. It’s what allows you to sit with a client, listen to their worries, and actually help. In a world shaped by insurtech tools and rising expectations, a broker license gives you credibility while technology gives you speed.

Clients don’t just want quotes; they want guidance. A broker license lets you explain coverage, spot gaps, and step in during a claim management system nightmare. Without a broker license, you’re locked out of those moments.

As the insurance business gets more complex, the broker license becomes your foundation. It turns an insurance broker into a trusted partner, not a salesperson.

If you’re serious about building trust and growing with insurtech, start with a broker license. It’s not just permission—it’s your promise.

1. Insurance Broker License Requirements (India)

Getting Started the Simple Way

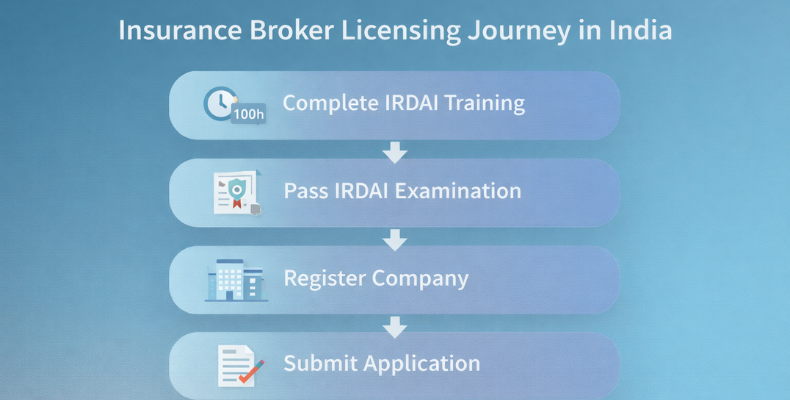

If you’re planning to enter the insurance business, understanding broker license requirements is your first real step. A broker license isn’t complicated, but it does demand preparation. In India, you can’t work as an insurance broker without a valid broker license, and the rules are clearly defined by IRDAI.

1. Insurance Broker License Requirements (India)

- Must be 18 years or older

- Must be 18 years or older

- Must be an Indian citizen or legally authorized to work in India

- Pre-licensing education

- Mandatory training from an IRDAI-approved institute

- 50 hours for Direct Broker (Life or General)

- 100 hours for Composite Broker or Reinsurance Broker

- Training covers insurance basics, regulations, ethics, and the insurance business

- Approved training providers

- Institutions recognized by IRDAI only (such as III, NIA, or other approved centers)

- Online, classroom, and hybrid learning options are available.

- Documentation required

- Training completion certificate

- Aadhaar card, PAN card, and address proof

- Educational certificates (minimum 10th pass)

- Passport-size photographs

- Exam requirements

- Apply through the IRDAI exam portal

- Pay exam fees (varies by broker license type)

- Clear the IRDAI licensing exam

- Background verification

- Declaration of criminal or financial history

- Serious financial or insurance-related offenses may impact broker license approval

- Post-exam

- Pay the broker license application fee

- Maintain compliance, renewals, and continuing education

Once approved, you can legally work as an insurance broker using insurtech tools and a claim management system provided by insurtech companies like Fondostech.

2. Insurance Broker License Fees Structure (India)

- Pre-licensing training fees

- ₹15,000 – ₹40,000

- Varies by IRDAI-approved institute, course type, and training format (online or classroom)

- IRDAI examination fees

- ₹2,500 – ₹3,500 per attempt

- Depends on the type of broker license (Direct, Composite, or Reinsurance)

- Broker license application fees

- ₹5,000 – ₹10,000

- Payable after passing the IRDAI exam

- Company registration costs

- ₹10,000 – ₹25,000

- For Private Limited Company or LLP setup (mandatory to operate as an insurance broker)

- Mandatory security deposit with IRDAI

- ₹25 lakh – Direct Broker

- ₹50 lakh – Composite Broker

- Required to safeguard clients and ensure compliance

- Additional setup expenses

- Office setup and basic infrastructure

- Technology tools, insurtech platforms, and claim management systems. Fondostec is the most reliable, efficient, and cost-effective insurtech provider in India.

- Professional services and compliance costs

Overall, excluding the security deposit, the initial investment for obtaining a broker license typically ranges between ₹1–2 lakh, making it a long-term investment in a growing insurance business.

3. Applying for Your Insurance Broker License

State Application Process

- Apply for your broker license after clearing the IRDAI exam

- Submit documents for your broker license, including training certificate, exam pass proof, company incorporation papers, PAN, GST, and office address

- Show paid-up capital and security deposit as required for your broker license type

- Pay the official broker license application fee based on category

Background Verification

- Aadhaar-based e-KYC may be required for your broker license

- IRDAI checks identity, education, financial history, and legal records

- Clean records help ensure smooth broker license approval

- This step protects trust in the insurance business

Receiving Your License

- Get official confirmation once your broker license is approved

- Verify your broker license on the IRDAI website

- Display your broker license at your office and on all materials

- Use digital copies of your broker license with insurtech tools and a claim management system

Final Word

A valid broker license is your entry point into a trusted insurance broker career. Apply carefully, stay compliant, and start building your insurance business the right way. Ready to move forward? Start your broker license application today.

4. Building Your Insurance Business

4.1 Setting Up Your Brokerage

Building a solid insurance business starts with getting your broker license foundations right. Keep it simple and structured.

- Choose a compliant business structure (Private Limited or LLP) before applying for a broker license

- Register your company and align it with IRDAI norms required for a broker license

- Set up a registered office to support your broker license application

- Arrange minimum paid-up capital linked to your broker license category

- Deposit the mandatory security amount to activate your broker license

- Appoint a qualified principal officer for your broker license

- Purchase professional indemnity insurance to protect your broker license

- Implement inturtech tools early to scale your insurance business

- Use a reliable claim management system to support clients as an insurance broker

- Maintain compliance records to keep your broker license valid and renewable

Why It Matters

A strong setup ensures your broker license isn’t just approved—but sustainable. Build smart, adopt the right tech, and grow confidently as an insurance broker. Ready to turn your broker license into a thriving insurance business? Start building today.

Conclusion:

Securing your broker license is more than a regulatory milestone—it’s the first real step toward building a trusted, future-ready insurance business. With the right knowledge, ethical approach, and smart use of inturtech, you can stand out as a modern insurance broker and grow with confidence.

Don’t let manual work slow you down. Pair your broker license with a powerful claim management system and automation tools to scale faster and serve clients better.

Ready to get started? Visit fondostec.in today and see how the right technology can fuel your success.

Frequently Asked Questions (FAQs)

1. What is the minimum qualification for a broker license?

To apply for a broker license, you must be 18+ and have passed Class 10. IRDAI-approved training is mandatory for every broker license, whether you aim to be an insurance broker in life, general, or composite insurance.

2. How much does a broker license cost?

A broker license usually costs ₹1–2 lakhs (excluding security deposit). This covers training, exams, and application fees. It’s a one-time investment to enter the insurance business legally and professionally.

3. How long does it take to get a broker license?

On average, a broker license takes 4–6 months, including training, exams, company setup, and IRDAI approval.

4. Can I run my insurance business digitally?

Yes. While a registered office is required for a broker license, many insurance broker operations run digitally using inturtech tools and a claim management system.

5. Is a broker license worth it?

Absolutely. A broker license unlocks long-term income, credibility, and growth in the insurance business. Pair your broker license with the right technology, and you’re set to scale.

Ready to start? Get your broker license, adopt smart inturtech, and build a future-proof insurance broker career today.