Let’s be honest—insurance has never had a reputation for being exciting. Paper files. Endless data entry. Slow approvals. Frustrated customers waiting days for simple answers. But that version of insurance? It’s disappearing fast.

Modern insurance software is changing how policies are managed, how customers are served, and how insurance agencies stay competitive. This isn’t a “nice-to-have” upgrade anymore. It’s the difference between growing and getting left behind.

Customer expectations are higher than ever. Speed matters. Transparency matters. Experience matters. And insurance technology is finally catching up.

The Evolution of Insurance Software: Legacy to Cloud

Not long ago, insurance professionals were stuck juggling outdated systems that felt more like obstacles than tools.

Think green-screen mainframes. Separate logins for every carrier. The same data entered again and again. Hours lost—not serving clients, but fighting software.

The early shift to desktop applications helped, but only a little. Those systems were expensive, rigid, and tied to office computers. Customization was painful. Mobile access was almost nonexistent.

Then cloud-based insurance software changed everything.

Modern platforms are built for speed, flexibility, and scale. They update automatically. They work anywhere. They integrate with carriers, CRMs, accounting tools, and customer portals. Most importantly, they’re designed around how insurance professionals actually work.

The rise of insurtech pushed this evolution even faster. Startups and established providers alike are racing to deliver smarter, faster, more intuitive insurance solutions—and agencies are reaping the benefits.

Key Automation Features of Insurance Software Platforms

Ask any insurance professional where time disappears, and the answer is the same: manual work.

Modern insurance software attacks that problem head-on.

Automated Renewals That Don’t Slip Through the Cracks

Renewals shouldn’t be stressful—or missed.

Today’s insurance software tracks renewal dates months in advance, triggers reminders automatically, generates updated proposals, and follows up without anyone chasing spreadsheets. The result? Agencies using automated renewal workflows consistently see renewal rates climb by 15–25%.

More renewals. Less scrambling. Everyone wins.

Quote Generation That Takes Minutes, Not Hours

Remember when generating a quote meant bouncing between carrier websites, retyping customer data, and waiting for responses?

Modern insurance software connects directly to carriers, pulls pre-filled customer information, runs comparative rating engines, and builds polished proposals automatically. What used to take half a day now takes minutes—and customers feel that speed immediately.

Document Automation That Protects Accuracy and Compliance

Documents are where errors get expensive.

Insurance software now auto-populates forms from policy data, ensures required disclosures are always included, locks out outdated templates, and maintains audit trails automatically. Add digital signatures, and suddenly printing, mailing, and scanning are things of the past.

One template update can roll regulatory changes across every document—instantly.

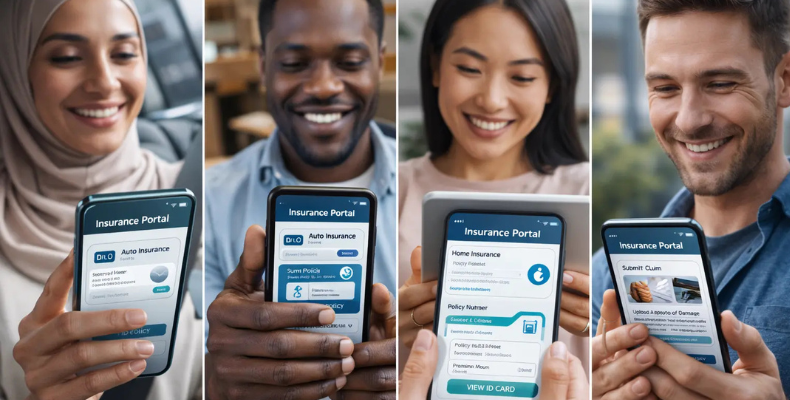

Customer Portals and Mobile Apps in Insurance Software

Today’s customers manage their lives on their phones. Insurance is no exception.

Modern insurance software delivers customer portals and mobile apps that give policyholders 24/7 access to what they need—without calling the office.

They can:

- View policies and coverage details

- Download ID cards and certificates

- Check claim status

- Make payments

- Request coverage changes

- Upload documents

For customers, it’s convenience. For agencies, it’s fewer routine calls and more time for high-value conversations.

Mobile apps take it even further with photo-based claims, push notifications, chat with agents, and digital ID cards—insurance that actually fits into real life.

Real-Time Analytics That Drive Smarter Decisions

Gut feelings don’t scale. Data does.

Modern insurance software turns raw data into real-time insights through dashboards and reports that actually make sense. Agencies can see new business trends, retention rates, commission performance, pipeline value, and growth patterns at a glance.

Even better? Predictive analytics.

Advanced insurance tech identifies customers at risk of non-renewal before it happens—based on payment behavior, engagement levels, service history, and life changes. That means agencies can step in early, not react too late.

Producer performance becomes transparent too. Quote-to-close ratios, cross-sell success, and revenue trends help managers coach smarter and reward fairly.

And commission reconciliation—once a nightmare—is now automated. Statements are matched, discrepancies flagged, and reports generated automatically, often eliminating entire administrative roles.

AI and Machine Learning in Insurance Software

Artificial intelligence isn’t coming to insurance—it’s already here.

Machine learning now extracts data from applications, policies, certificates, and loss runs in seconds. What once took 20 minutes of typing now takes a quick review.

AI-powered chatbots handle common customer questions anytime, using natural language—not rigid scripts. Customers get instant answers, and staff stay focused on complex issues.

Underwriting is evolving too. AI analyzes massive datasets to identify risk patterns, flag inconsistencies, and recommend coverage and pricing. Human expertise stays central—but it’s now backed by smarter insights.

Even cross-selling gets a boost. Machine learning reviews customer profiles and life stages to surface personalized coverage recommendations that feel helpful, not pushy.

Insurance Software Case Studies: Proven Results

The impact isn’t theoretical—it’s measurable.

One small-business-focused agency cut policy administration time by 40%, slashed quote turnaround by 60%, improved retention by 22%, and tripled revenue with only two additional hires.

Another independent broker used modern insurance software to compete head-to-head with national firms—boosting customer satisfaction by 35% and reducing service calls by half.

A multi-location agency standardized operations across seven offices and increased efficiency by 28%, simply by replacing inconsistent workflows with unified insurance software.

What’s Next for Insurance Technology?

Insurance software is quietly stepping out of the background and into the driver’s seat—and it’s not looking back.

Picture this: your car, your home, even your wearable tech constantly feeding insights that help prevent problems before they turn into claims. Pricing adjusts to real life, not rough guesses. Instead of reacting to risk, insurers start predicting it—and stopping it in its tracks.

Behind the scenes, technologies like blockchain clean up the mess no one likes to talk about. Claims move faster. Fraud gets harder to hide. Data flows where it should, without endless back-and-forth or blind trust.

Then there’s insurance that shows up exactly when you need it—baked right into everyday moments. Buy a product, book a trip, lease a car, and coverage is already there. No forms. No friction.

Add voice tools, immersive visuals, and experiences that actually make policies understandable, and something big becomes clear: insurance software isn’t just supporting the business anymore. It’s what makes the business run.

Choosing the Right Insurance Software for Your Agency

Modern insurance software isn’t about chasing trends. It’s about building a stronger, faster, more customer-centric insurance business.

It reduces costs. Improves service. Unlocks insights. Scales growth. And prepares agencies for whatever comes next.

The shift from legacy systems to cloud-based platforms, from manual work to automation, from reactive service to proactive engagement—this is the new standard.

Insurance agencies that invest now don’t just survive. They lead.

The future of policy management and customer service is digital, automated, and deeply human—and modern insurance software is the foundation making it possible.

conclusion:

Ready to Transform Your Insurance Business?

If you're still doing manual work, it means you're not using the right tools. Agencies that use modern software tools provide personalized and fast service to their customers.

Whether you’re a solo agent planning to scale or an established agency ready to modernize, insurance software is no longer optional. It’s essential.

That’s where Fondostec comes in.

We help insurance agencies and brokers implement insurance software solutions built for real-world challenges—flexible, scalable, and growth-ready.

Take the Next Step

Outdated systems cost you time, revenue, and customers. Schedule a free consultation with Fondostec and see what modern insurance software can do for your business.

Frequently Asked Questions

1. What is insurance software, and why do agencies use it?

Insurance software helps insurance agencies and brokers manage policies, generate quotes, automate renewals, track commissions, and serve customers faster. Modern insurance software replaces manual work, connects with carriers, and provides real-time insights—saving time and improving customer retention.

2. How much does insurance software cost for small agencies?

Most cloud-based insurance software costs $50–$300 per user per month. Many insurtech platforms offer flexible pricing so small agencies can start small and scale. The return is strong—many agencies see 3–5X ROI through efficiency and revenue growth.

3. Can insurance software integrate with carriers and other tools?

Yes. Modern insurance software integrates with major insurance carriers, CRMs, accounting systems, email tools, and document management platforms. These integrations eliminate duplicate data entry and streamline workflows.

4. How long does it take to implement insurance software?

Implementation usually takes 4–12 weeks. Cloud-based insurance software deploys faster and includes data migration, training, and carrier integrations. Most insurtech providers offer hands-on support to ensure a smooth transition.

5. What’s the difference between insurance broker software and insurance agency software?

Insurance broker software focuses on multi-carrier quoting and commission tracking. Insurance agency software may support carrier-specific workflows. Today’s modern insurance software platforms support both models with flexible, scalable features.